May 24th 2015, 17:37 BY THE ECONOMIST

Our coverage on the award of the Nobel prize for economics to John Nash in 1994

The games economists play | Oct 15th 1994

Game theory is now part of almost every economist's tool-kit, as this week's Nobel economics prize recognises

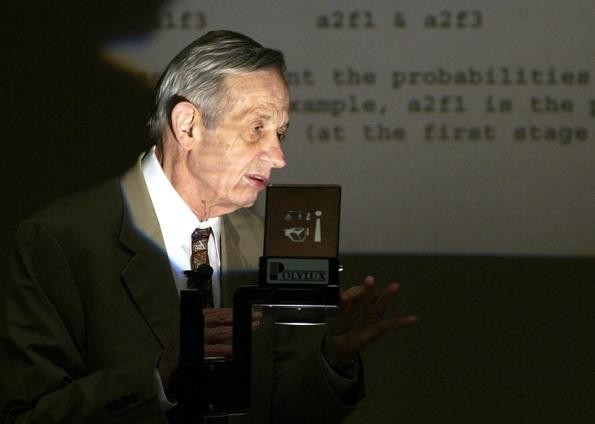

IT SOUNDS like a sports fan's dream. In Stockholm on October 11th, three men shared a $1m prize for their skill at analysing games. They are not television pundits, or armchair critics of Manchester United or the Miami Dolphins, but economists. Two Americans, John Harsanyi and John Nash, and a German, Reinhard Selten, have won this year's Nobel prize for economics for their studies of "game theory".

Game theory may sound trivial. It is not. In the past 20 years or so it has revolutionised the economics of industrial organisation and has influenced many other branches of the subject, notably the theories of monetary policy and international trade. These days, no economics students can hope to graduate without knowing the rudiments of it.

Odd though it may seem, until game theory came along most economists assumed that firms could ignore the effects of their behaviour on the actions of others. That is fine when markets are perfectly competitive: what one firm or consumer does can make no difference to the overall picture. Fine, too, when unchallenged monopolists hold sway: they have no rivals to worry about.

But in many instances this assumption is wrong. Many industries are dominated by a few firms: by building a new plant or cutting prices (or threatening to cut them), a firm can affect how its rivals behave. And it is not just in industrial economics that such calculations matter. Some countries may impose (or threaten) trade sanctions against others in an attempt to prise open protected markets. A government may put up short-term interest rates when inflation is low to convince financial markets that it is serious about fighting inflation; with luck, the markets will then require lower long-term interest rates.

These examples are, in a way, just like games: no football coach plans an attack without taking into account the defenders' likely response. Modern game theory was fathered by John von Neumann, a mathematician, and Oskar Morgenstern, an economist, who published "Theory of Games and Economic Behaviour" in 1944 (an anniversary which was not lost on this year's Nobel-prize givers). Messrs Harsanyi, Nash and Selten have honed it into the sharp tool economists use today.

In the early 1950s Mr Nash produced a compelling way of working out how games will end up when players cannot commit themselves, or do not want to collude with each other. A "Nash equilibrium" occurs when no player wants to change his strategy, given full knowledge of other players' strategies.

Take one famous example of a Nash equilibrium. An industry has two firms (1 and 2). Each of them can choose a "high" or a "low" price. If they both choose high prices, they make hefty profits, of $3m apiece. With low prices, they make only $2m each. But if one sets a high price and the other a low one, the low-price firm makes $4m; the high-price firm gets a mere $1m. Although the firms would do best if they both set high prices, they will not. If firm 1 sets a high prices, firm 2's best choice is to undercut it: it would earn $2m instead of $1m. The same goes for firm 1: it too sets a low price. So they both choose low prices—and they make only $2m each.

The incredible game theorist

But Mr Nash's work needed refining. First, it applies to games played only once, or in which players move simultaneously. But virtually all interesting economic games involve continual interaction between players. Mr Selten extended the Nash equilibrium to such settings. From that emerges the importance of credibility: there is no point in one player following a plan which other players know will have to be changed at some point.

For example, a monopolist might try to keep a would-be rival out of its market by threatening a price war if the rival steps in. Such a war might mean that the entrant would make a loss. But it would be costly for the monopolist, too. If the price war costs a lot, the monopolist would do better to share the market with the new entrant. In that case, the threat of a price war is not credible: the entrant can go into the market, knowing that the incumbent would be foolish to fight back.

Second, it is not realistic to assume that the players know what is in each other's minds. As Adam Brandenburger of Harvard Business School puts it, "games are played in a fog." Mr Harsanyi cut through the mist, by showing that games in which players are not well informed about each other can be analysed in almost the same way as ordinary games.

When some players have information that others do not, their strategies can alter their reputations to their advantage. A government that shoves interest rates up to signal its anti-inflationary credentials is one example. Or take a monopolist that would like to stop entry into its market. It can do so if would-be rivals fear that it likes fighting price wars, in spite of the cost. By fighting anyone who does enter, the monopolist can built a reputation as a price warrior and put other entrants off. And oligopolists may be able to keep profits up by setting high prices and nurturing reputations for being friendly to their rivals.

Yet some economists are still wary of game theory, despite the insights it has brought. That is partly because the theory is difficult: it demands lots of tricky mathematics. That, however, is merely a reflection of the complexity of the world. But there is a more telling objection—namely, that game theory is just that: theory. So far there have been precious few real-life applications. Game theorists have been good at explaining the intricacies underlying strategic interdependence and producing ever more refined concepts of equilibrium but less adept at giving governments and firms practical advice.

Even that criticism, though, is weakening. Central bankers now know all about reputation and credibility. America's Federal Communications Commission used game theorists to design this year's auction of radio spectrum. And businesses, too, are beginning to learn about game theory: Harvard's Mr Brandenburger, for example, teaches it to MBA students and executives. The time is coming, he says, when self-respecting MBAs, as well as economics graduates with a taste for maths, will not leave school without it.